. . . Preserve Rural Milton’s Tax Exempt Status Has Been Revoked.

After pledging to run a positive campaign (see above excerpt from Ms. Rencher’s campaign website), in the closing days of the election, mayoral candidate Laura Rencher has launched a massive personal attack on Mayor Joe Lockwood. Ms. Rencher has made several negative allegations about Mr. Lockwood, including some allegations relating to the IRS. It is a desperation move.

You see, Ms. Rencher’s campaign has been stuck in neutral since it started. Wisely, Mr. Lockwood has mostly ignored Ms. Rencher. I have also mostly ignored Ms. Rencher at this blog, which drives Ms. Rencher and her small, unmerry band of followers crazy. They endlessly and incoherently rant and rave in a mostly empty room. To acknowledge Ms. Rencher is to undeservedly elevate and dignify her. I hope Mayor Lockwood will continue on the high road and ignore Ms. Rencher. However, Ms. Rencher’s hypocrisy in making IRS allegations compels me to respond. You see, Ms. Rencher has IRS issues of her own. She lives in the proverbial glass house . . . in her case, a virtual Biltmore mansion of a glass house. Oh, where to begin . . .

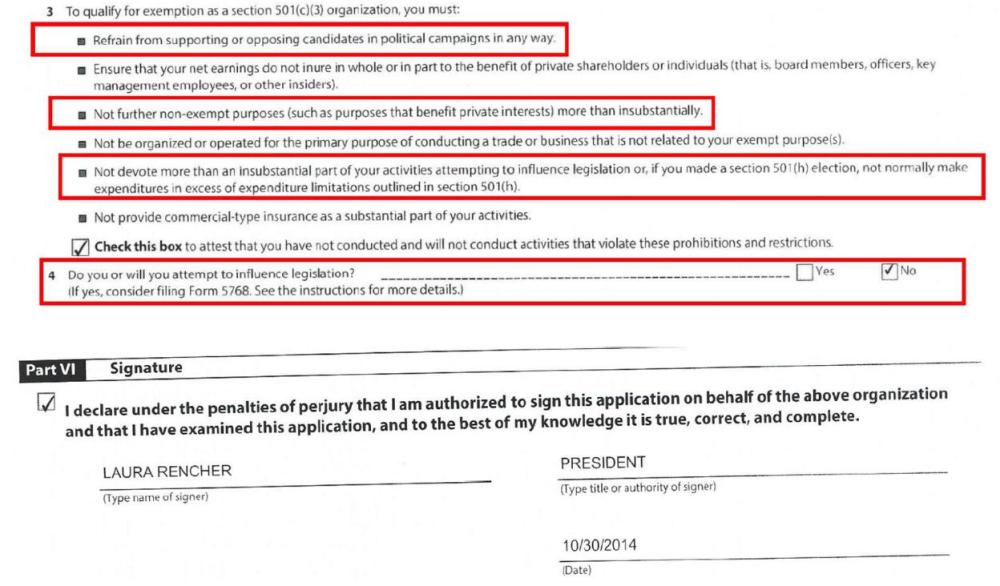

. . . perhaps at the beginning. Ms. Rencher co-founded an educational charity named Preserve Rural Milton (PRM). That’s right . . . an educational charity. Confused because PRM is clearly a political advocacy/lobbying group? Confused because a tax-exempt organization is not supposed to engage in political lobbying, which is what PRM mostly does? Did you give money to PRM under the false pretense that it was going toward educating citizens about land conservation? Following are excerpts from PRM’s IRS application for tax-exempt status designating PRM as an educational charity.

And later in her application, Ms. Rencher affirms that PRM will not attempt to influence legislation. Of course, for the last 2+ years, PRM’s primary focus has been on political advocacy. This includes attempting to influence legislation—for example, PRM’s emails, Facebook postings, and petition advocating for passage of the so-called “Conservation” Subdivision Ordinance, or CSO. The IRS website states that a tax exempt organization: “may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities.” The IRS website further states:

“An organization will be regarded as attempting to influence legislation if it contacts, or urges the public to contact, members or employees of a legislative body for the purpose of proposing, supporting, or opposing legislation, or if the organization advocates the adoption or rejection of legislation.”

Following are the conditions agreed to by Ms. Rencher to obtain tax-exempt status. Note the language relating to perjury in the signature section.

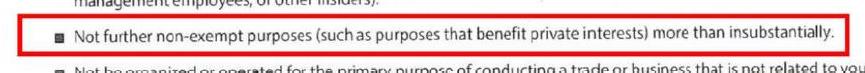

And Ms. Rencher also seems to have violated the IRS’s stipulation that tax-exempt organizations “not further non-exempt purposes (such as purposes that benefit private interests) more than insubstantially.” The IRS website states that a tax-exempt organization “must not be organized or operated for the benefit of private interests, such as the creator or the creator’s family, shareholders of the organization, other designated individuals, or persons controlled directly or indirectly by such private interests.” Following is the stipulation, agreed to by Ms. Rencher, in her application for tax-exempt status:

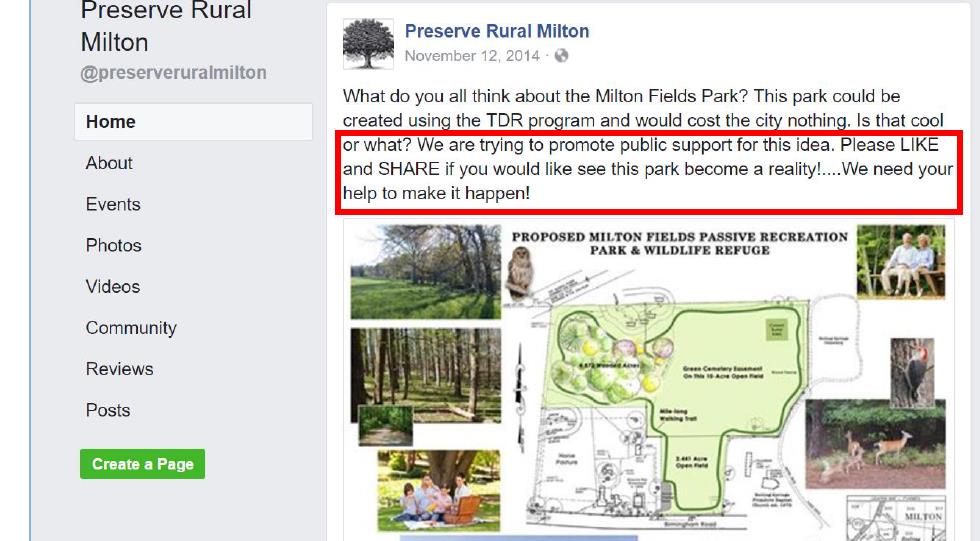

Preserve Rural Milton has advocated that the City of Milton acquire land adjoining the property where PRM’s President (Laura Rencher) lives. PRM has proposed that this property be converted to a passive-use park. PRM has developed and published (at PRM’s Facebook page) a plan for this park. The President of PRM, Ms. Rencher, would almost certainly benefit financially from such a park being established next to her property (vs. construction of a subdivision, for example). Following is a post from PRM’s Facebook page advocating for establishment of the park next to her property.

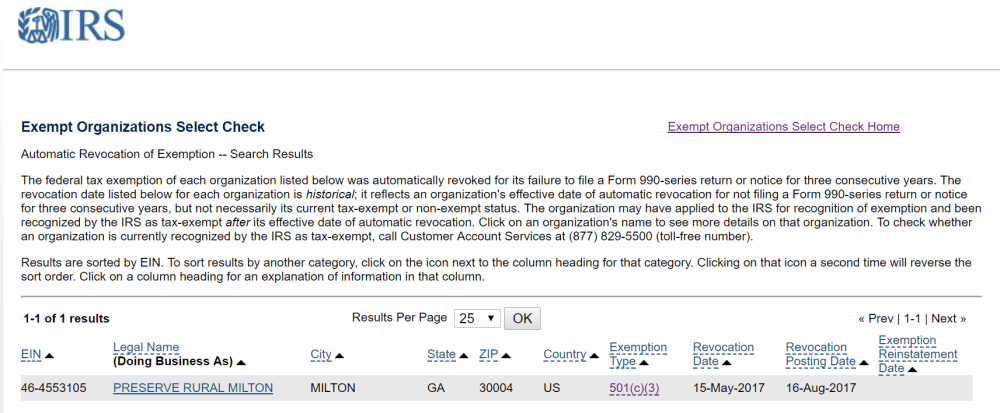

Finally, it should be noted that PRM’s tax-exempt status has been revoked because PRM has not filed the required annual forms for 3 consecutive years. This revocation occurred on May 15, 2017. Following is a screen shot from the IRS’s website:

So it is fair to say that Ms. Rencher and PRM are in deep kimchi with the IRS. And talk about lack of transparency . . . there are no annual forms for the public to inspect, which is a requirement for tax-exempt status. And the lack of reporting begs the question of how PRM has used the funds that it has raised.

(Note: PRM has taken down both its website and its Facebook page. However, I have extensive screenshots of both for public inspection.)

And it is interesting to note that both Ms. Rencher and her running mate Bill Lusk have misused the assets of tax-exempt charities to further their political aims. Not only have they run afoul of IRS rules for charities, Rencher-Lusk have also violated the public trust. They are 2 peas in pod. Citizens, we can do better than Rencher-Lusk . . . Vote Lockwood-Bentley! Vote for Integrity and Good Governance!

Advocating For Clean Government,

Tim Becker