October 30, 2017

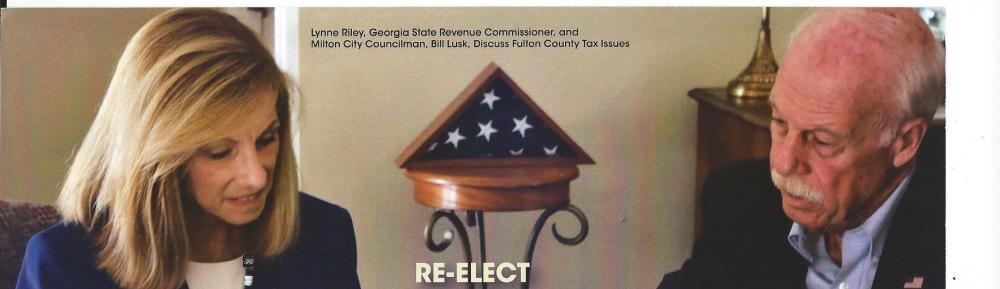

Bill Lusk probably regrets his latest mailer. It is yet another Whoops moment for Mr. Lusk. The mailer shows Lusk with Lynn Riley, the Georgia State Revenue Commissioner, who just a few days ago became Fulton County’s most unpopular government official. Read on . . .

This is Mr. Lusk’s third mailer. Lusk seems to be zig-zagging, trying to find a message that will resonate with voters. So far, without success. In his first mailer, Mr. Lusk highlighted his volunteerism, patriotism, and veteran’s status. However, this strategy blew up when it was discovered that Lusk was using his Memorial Markers veterans charity’s email list (generated by the city) for campaign solicitations. Reprehensible, to say the least. Mr. Lusk then manufactured a number of accomplishments that didn’t pass the smell test. Being for or against something is not an accomplishment. And if you have to stretch back 5 years or 12 years for an accomplishment, that only serves to underscore a lack of accomplishment. (In an earlier post, Mr. Lusk’s accomplishments were thoroughly debunked.)

Mr. Lusk’s latest strategy seems to be highlighting his relationships with various county and state officials. At meet-the-candidate events (e.g., at the Manor), Mr. Lusk intimates that he has, and can continue to, grease the skids with various government officials . . . hence, his photo with Lynn Riley, the Georgia State Revenue Commissioner. Mr. Lusk seems to be implying that he can leverage this relationship with Ms. Riley to achieve tax fairness for voters. But here’s the problem for Mr. Lusk. While his mailer was coursing its way through the U.S. postal system, Ms. Riley’s Department of Revenue rejected Fulton County’s tax digest.

Fulton County tax digest rejected by state Department of Revenue

We are now back to square 1 and potentially looking at paying inflated tax bills that caused so many of us to flood town hall meetings across Fulton County in June. So Mr. Lusk has unwittingly hitched his wagon to Fulton County’s most unpopular government official. Whoops!

It seems that Mr Lusk’s tall tales about his role in rolling back the 2017 property valuations are unraveling. The truth is that Mr. Lusk di little to oppose the huge property tax hikes in June. I was heavily involved with fighting the inflated tax assessments. And I can tell you that Mr. Lusk did NOT play a prominent role in opposing the property tax increases. I only saw him at one town hall meeting, where he was silent. Mr. Lusk did not attend nor speak at the all-important Fulton County Board of Assessors (BOA) meeting in downtown Atlanta. I did attend and speak, as did Commissioner Bob Ellis, Mayor Lockwood, and Council Member Matt Kunz. Mr. Lusk was nowhere to be found. Following is a link to the Fulton County BOA meeting. Scroll down and click on “Discussion 2017 of Property Values.” You can hear Mayor Lockwood speak at 30:30 and me speak at 37:00.

Discussion 2017 of Property Values

Furthermore, when the inflated tax appraisals were first broached at City Council, Mr. Lusk said NOTHING . . . not a peep.

In fact, Lusk’s actions in response to the tax increase were counterproductive. Mr. Lusk joined Council Members Thurman and Kunz in quickly surrendering on the tax increase and instead promoting a roll-back of Milton’s millage rates. This roll-back, which would have had little effect on overall property taxes, was a transparent attempt to curry favor with voters in advance of the election. At best, Lusk’s millage rate proposal was distraction from the main battle against the tax assessments; at worst, Mr. Lusk undermined efforts to rescind the tax assessments. Mr. Lusk only jumped on the opposition bandwagon once citizens’ ire became clear to him. His sole contribution was signing a letter opposing the tax increase that was signed by all 7 council members.

Tim Becker

June 13, 2017

June 13, 2017